PCORI Fee Due July 31

Understand the when, what and why of the Patient-Centered Outcomes Research Institute (PCORI) fee.

WEBINAR: Human Resources 101

Join us on July 16 from 9:30-10:30AM for OneGroup’s next 101 Series webinar: HR 101. OneGroup’s Nicole Bryant and Brittani O’Connell will discuss the I-9 essentials every employer should know. Break down the core compliance requirements for completing, storing, and re-verifying Form I-9s and learn how to spot and correct common errors before they become costly.

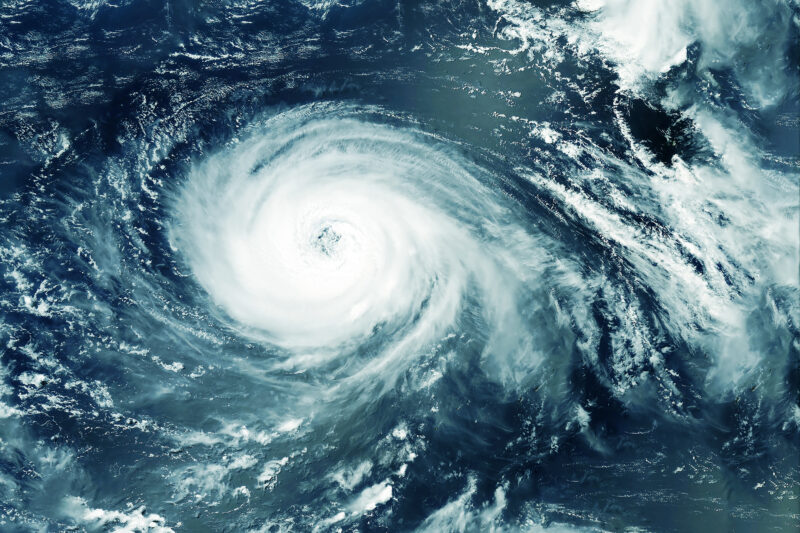

Hurricane Preparation Checklist for Homeowners

When hurricane season is around the corner, the best thing you can do for your business is prepare. Fortunately, hurricanes and tropical storms never come unannounced.

Leading Experts on Your Side

From business liability to personal protection – our experts have the knowledge and tools to help you reach your goals.

Learn More

Risk Transfer:

Next-Level Protection

Transferring risk to your contractors, sub-contractors or clients is tricky, but absolutely critical. Let our experts help.

HR Solutions All in One Place

Our team can help at any level from consulting to total outsourcing.

Cyber Attacks Happen More Often Than You’d Think

Talk to our team about the insurance and risk management tactics you can use to keep your data safe. Learn More.

ONEGROUP EXPERTS ARE READY TO HELP

Fill out the form below and an expert from OneGroup will contact you.

For Immediate assistance call 1-800-268-1830

OneGroup will respond during hours of operation. Coverage cannot be bound or altered and a claim cannot be reported without confirmation from a representative of OneGroup.