NEWS & INSIGHTS

Information to help you make better, more informed decisions.

Topics

Content Type

Search

Workplace Wellness Trends To Stay on Top of in 2025 (and Beyond)

Making wellness a cornerstone of your benefits strategy can lengthen employee tenure, reduce turnover and save on human capital costs. Here are five innovative ways to put wellness front and center.

School Buses Are Rolling Risks

With proper insurance and safety management, your school district can avoid various losses and complaints. And you can go on providing a great environment for students to travel to and from school and events.

Welcome Stacey Pettyjohn to OneGroup

Welcome Vinse Delmage to OneGroup! He has joined our team as Regional President, Western New York and Senior VP, Insurance Placement.

What Is an OSHA Recordable Injury?

Many employers with 11 or more employees are required to keep a record of serious work-related injuries and illnesses. Here's an overview of the Occupational Safety and Health Administration’s recordkeeping requirements.

Navigating Medicare Eligibility with an HSA

At OneGroup, we understand that navigating the complexities of Medicare can be overwhelming. That's why we're here to help you make informed decisions about your healthcare coverage and maximize your savings.

PCORI Fee Due July 31

Understand the when, what and why of the Patient-Centered Outcomes Research Institute (PCORI) fee.

WEBINAR: Human Resources 101

Join us on July 16 from 9:30-10:30AM for OneGroup's next 101 Series webinar: HR 101. OneGroup's Nicole Bryant and Brittani O'Connell will discuss the I-9 essentials every employer should know. Break down the core compliance requirements for completing, storing, and re-verifying Form I-9s and learn how to spot and correct common errors before they become costly.

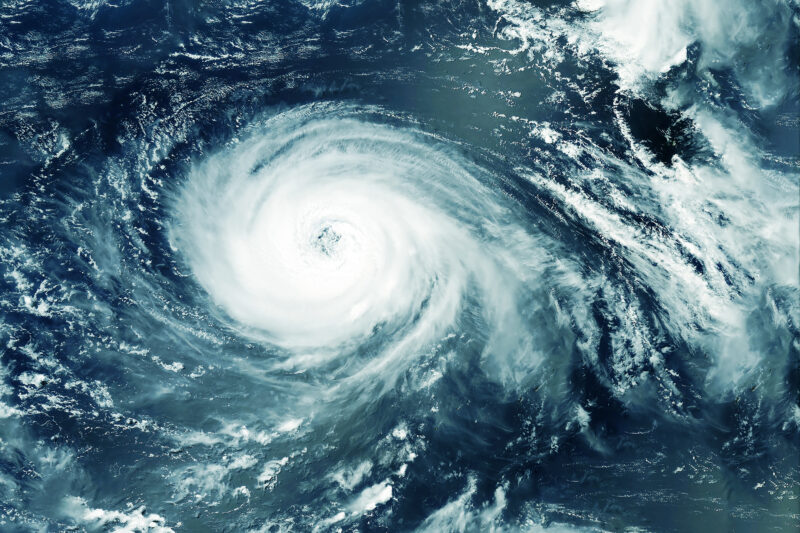

Hurricane Preparation Checklist for Homeowners

When hurricane season is around the corner, the best thing you can do for your business is prepare. Fortunately, hurricanes and tropical storms never come unannounced.

Understanding the Potential of ‘Employment Extenders’

Employees are increasingly working past the traditional retirement age. Explore the advantages of this demographic and the benefits essential to attracting and retaining them.

OneGroup provides information, research, guidance, and best practices, but does not offer specific legal or tax advice. OneGroup services are not intended to be a substitute for legal or tax advice. Given the changing nature of federal, state and local legislation and the changing nature of court decisions, OneGroup cannot guarantee that the information will not change in the future. It is recommended to seek legal or tax guidance if such guidance is warranted or preferred.