Inland Marine

You’re on the Move! We’re With You Every Step of the Way

We work to protect companies of every size, many that are in highly specialized businesses. Often, they have property in transit over land or sea, shippable high-value objects, transportable equipment, or other specialized possessions. Inland marine insurance’s definition has evolved over time to cover a growing range of property and materials. OneGroup’s business risk specialist can advise you as to the correct coverage for each situation to ensure protection of your assets.

Inland Marine provides property coverage for items that usually do not remain at a fixed location and/or provides broader coverage than the standard property policy form. Some types of property to be covered would be, goods or materials in transit, property at off-site storage, property under construction, rigger’s liability, equipment installation, contractor’s equipment, communication towers, computers, etc.

Various inland marine insurable assets include:

- Property in transit

- Property such as bridges and radio towers

- Mobile medical equipment

- Contractors equipment

- Accounts receivable

- Builders’ risk

- Cameras and photographic equipment

- Computers

- Contractors equipment

- Dealers

- Exhibitions and museums

- Fine art

- Leased property

- Mobile medical equipment

- Motor truck cargo

- Musical instruments

- Rigger’s liability

- Scheduled Property

- Transportation

- Valuable documents

You can’t always be at your business location or guarding your assets. Inland Marine Insurance is the answer. Working with a company like OneGroup that specializes in business risk is the solution.

We make it easy for you. That’s why so many people turn to OneGroup for their inland marine. Save time. Save money.

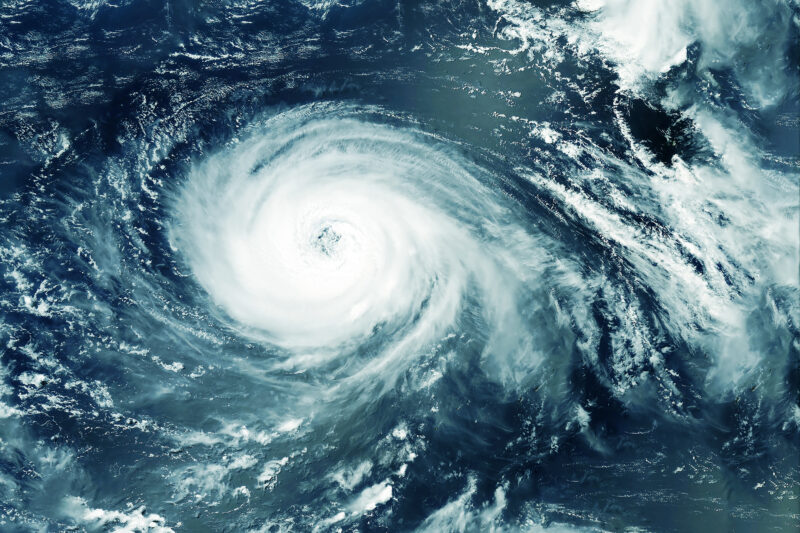

Hurricane Preparation Checklist for Homeowners

When hurricane season is around the corner, the best thing you can do for your business is prepare. Fortunately, hurricanes and tropical storms never come unannounced.

Your Nonprofit might have hidden gaps in protection

Use this checklist to uncover the hidden risks in your nonprofit operations.

Protect Your Subcontracting Business From Big Claims

Subcontractors on a construction project face many risks, from serious injuries to property damage and costly delays. To avoid a big loss, make sure you’re adequately insured. Commercial general liability, workers’ compensation, inland marine and installation floater insurance are just some of the coverages you may need.